Whether you’re a first-time traveler or a citizen of the world, travel insurance should be a top priority. Even if you don’t have all the nitty gritty details of your itinerary ironed out, it’s important to know that there are perks to buying travel protection within 14 days of booking your trip in order to enjoy your coverage to the fullest, rather than buying it at the last minute.

The earlier, the better

The sooner you buy coverage for your trip, the sooner your coverage starts. A good rule of thumb to follow: right when you book your flights or hotel stay is when you should get your trip covered.

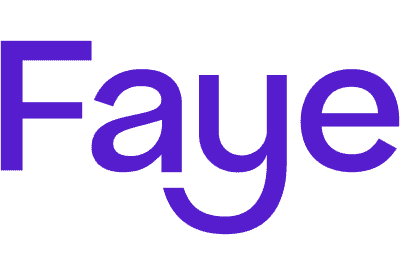

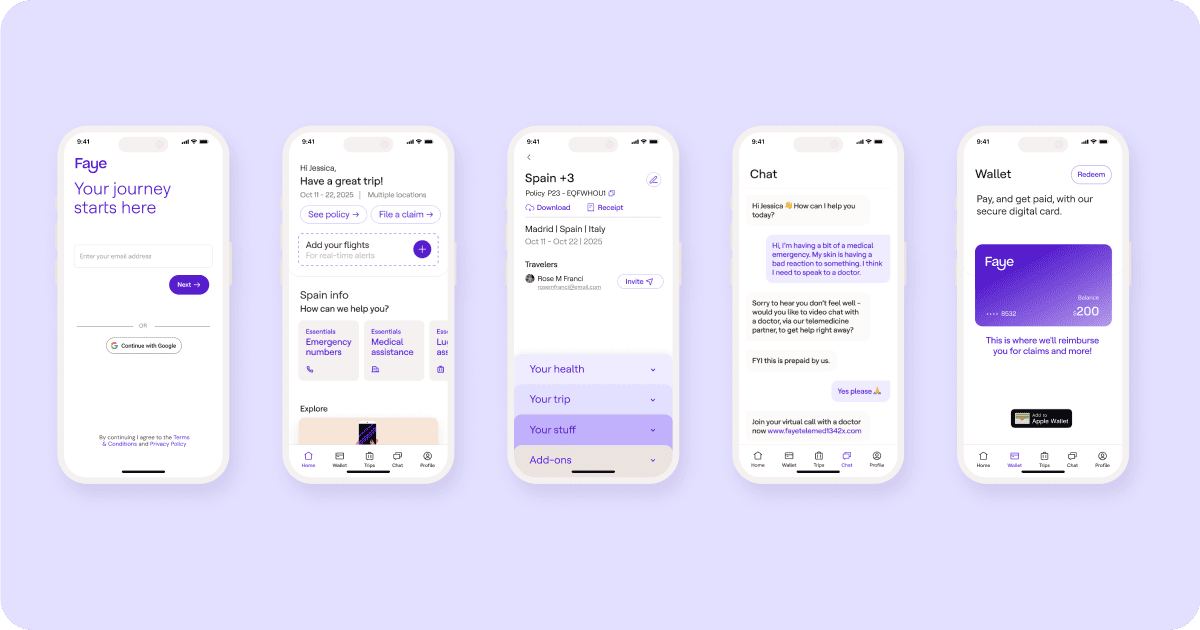

With Faye, if you need to cancel your trip for covered reasons, including if you get sick before your trip begins, up to 100% of your non-refundable trip costs can be covered – like flights, hotel bookings, tickets & activities, and more. This benefit kicks in the day after you purchase your policy.

You’ll also have access to 24/7 travel experts via the Faye app who can help with trip planning, answer any burning questions you have in regards to your itinerary.

And by purchasing your travel insurance within two weeks of your initial trip deposit, you’ll be eligible for pre-existing medical condition coverage or optional upgrade coverage, like Faye’s Cancel For Any Reason add-on. Let’s dive into those.

Coverage for pre-existing medical condition

Your travel insurance may provide coverage related to your health while abroad if you fall ill or get injured, like hospital visits, prescriptions and other services, up to your policy limits. And remember, most health insurance plans do not fully cover illness/treatment while traveling outside of the United States. In the case of a pre-existing medical condition, you’ll need to meet a few requirements in order to be covered.

Faye’s travel protection covers pre-existing conditions, as long as you purchase your plan within 14 days of your initial trip deposit, and are medically able to travel when you purchase your plan.

Cancel For Any Reason coverage

Cancel For Any Reason (CFAR) coverage gives you peace of mind for when you want to nix your plans for reasons other than those already covered. This can include fear of getting sick, a last minute work obligation, contracting COVID-19, or you simply not wanting to hit the road anymore.

Purchasing CFAR falls under the 14 day rule we previously mentioned – you must purchase this add-on within two weeks of booking and cancel your trip at least 48 hours prior to your scheduled departure date.

With Faye, the CFAR coverage add-on means you’ll get up to 75% back on non-refundable trip costs so you don’t lose your entire trip investment.

Don’t delay, buy early

Many travel insurance providers opt to not offer pre-existing medical coverage or up to 75% back if you cancel your trip for any reason. Faye goes the distance to do both to make sure you’re protected from the moment you book until the moment you return home.

You’ve put in a lot of effort planning your trip – so don’t make the mistake of not protecting it to the fullest by not finding out more about our coverage.

*Losses due to, arising or resulting from pre-existing conditions are normally excluded from coverage. However, such losses are covered on the same basis as losses due to, arising or resulting from all other sicknesses and injuries if you qualify for the Pre-Existing Medical Condition Exclusion Waiver.