It’s no secret that insurance plans can include a lot of jargon that you might not be familiar with. That’s why we’ve created this digestible glossary for you so you can understand your travel insurance plan to the fullest prior to hittin’ the road.

Travel insurance terminology explained

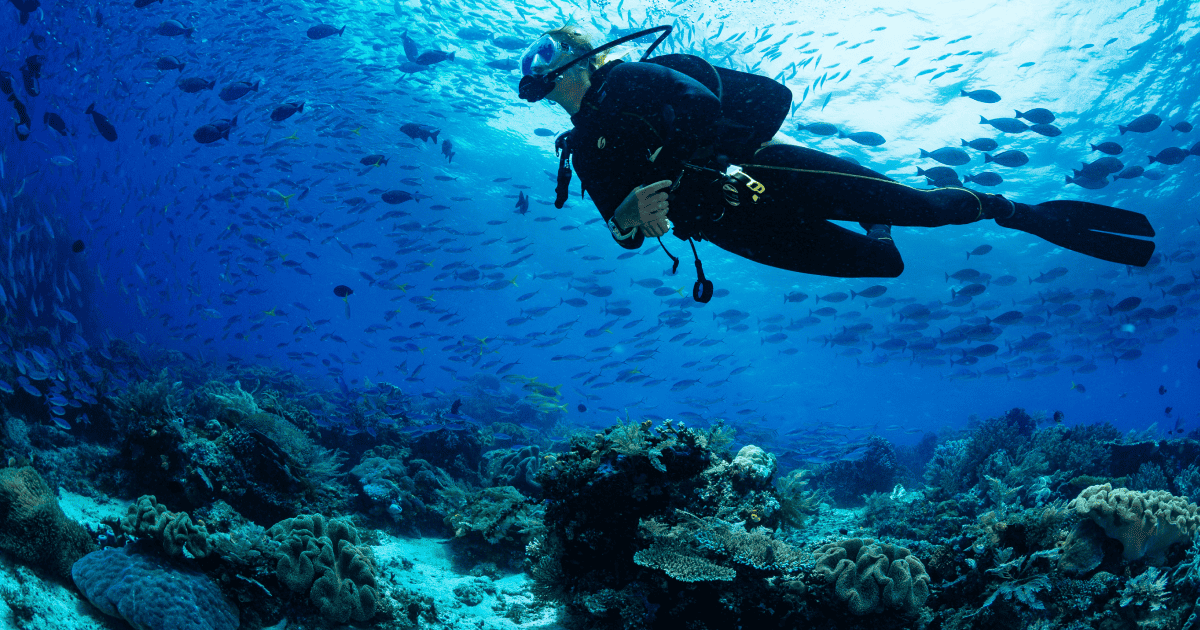

- Adventure & extreme sports: With this add-on, if you get injured while engaging in an adventure or extreme sport such as skydiving, bungee jumping, motocross, or free diving, you can be covered for medical and transportation expenses.

- Cancel for Any Reason (CFAR): An add-on to your Faye travel insurance plan that enables you to cancel your trip for any reason in addition to those covered, no later than 48 hours prior to your scheduled departure date, even if you just don’t feel like going.

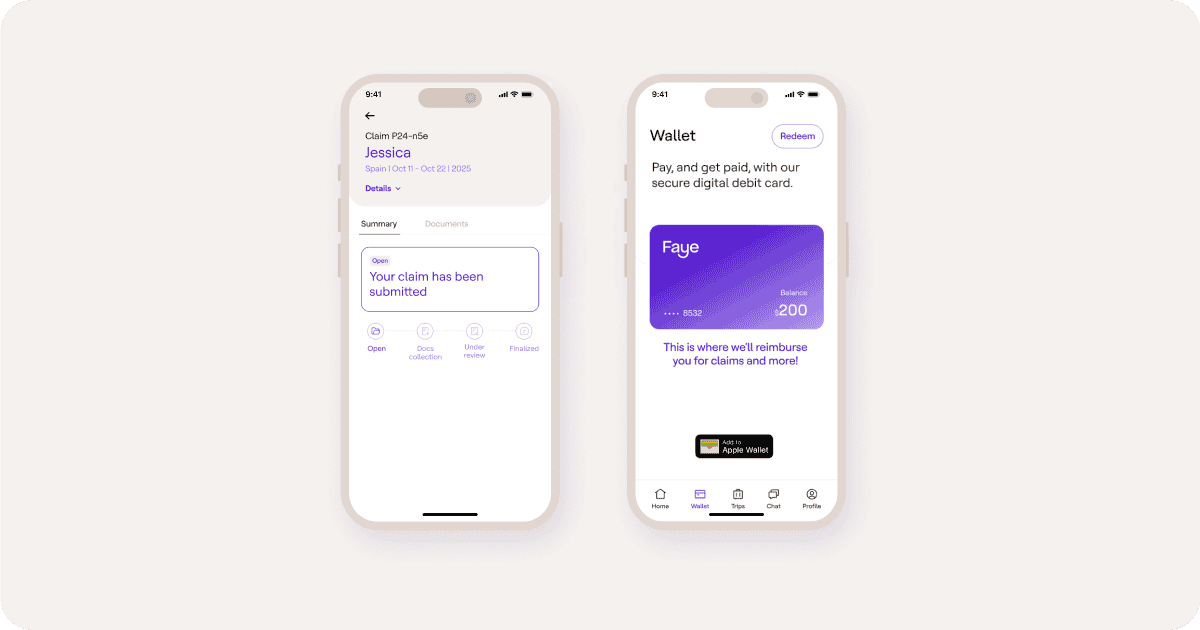

- Claim: The process of a traveler submitting documentation to their insurance provider for reimbursement of a covered expense. Reimbursement is subject to what is covered in the plan.

- Emergency care coverage: Medical care that requires immediate assistance and is covered by your plan.

- Emergency evacuation: Medical Transportation that’s needed to take you to the nearest facility that can treat you appropriately.

- Emergency medical expenses: Coverage for prescription drugs, hospitalizations and physician costs, if you become ill or injured while traveling.

- Excess: This term refers to how your travel insurance plan will interact with other coverage you may have. For instance, if your medical coverage is excess, it will pay only after your primary coverage has been paid. Your plan will clarify whether coverage is excess or primary.

- Exclusions: Events or activities not covered by your travel insurance coverage.

- Lookback period: The period of time your insurance company will “look back” to determine if there has been a change in medical condition and if a claim is related to a pre-existing condition.

- Pet care: The coverage of pet health-related expenses if your furry friend gets sick while traveling with you, if your pet has to be quarantined due to sickness, or if you don’t arrive home on time resulting in additional kenneling expenses. Quarantined means your travel companion is forced to strict medical isolation by a recognized government authority or medical examiners if they have – or are suspected of having – a contagious disease, infection, or contamination.

- Pre-existing medical conditions: Health conditions or illnesses that you have been diagnosed with or have received treatment for before purchasing travel insurance that can potentially be covered for trip cancellations and interruptions. You need to purchase your plan within 14 days of your initial trip deposit and be medically able to travel when you purchase to receive this benefit.

- Primary: This refers to the priority of payment when you file a claim. For example, if you purchase a travel insurance plan with primary emergency medical benefits, that means the travel insurance company is the first to pay or reimburse for those benefits.

- Rental car care: A benefit you can add on to your travel insurance policy for coverage of car rental-related accidents and theft expenses, such as coverage for collision, loss, and damage.

- Repatriation: If you fall ill or get injured while traveling, your insurer will arrange for you to get home for treatment. In addition, repatriation coverage includes handling the necessary transportation home if the insured passes away from illness or injury during the trip.

- Telemedicine: Connects patients virtually with a network of licensed physicians for medical advice and treatment, including prescribing medication (when appropriate and legally permitted). This service allows those in need to request a virtual visit with a doctor 24 hours a day, 365 days a year.

- Trip cancellation: When a traveler must unexpectedly cancel their travel plans. Typically this covers a number of cancellation reasons, including injury, illness, or death of a covered person.

- Trip delay: When a traveler is stranded in transit due to uncontrollable reasons, including a flight delay or theft of passport.

- Trip inconveniences & snafus: When a traveler is inconvenienced during their trip due to flight delays, cancellations, security delays or arriving late to their hotel.

- Trip interruption: When a traveler must unexpectedly cut their trip short or extend their trip, changing their planned return date home.

- Urgent care: Medical care that shouldn’t be postponed but doesn’t pose a life-threatening situation.

- Vacation rental damage protection: An add-on to your trip that gives you coverage for any unintentional damage to a vacation rental property that you’re staying in during your trip.

- Whole-trip travel insurance: Whole-trip travel insurance is coverage that goes the distance to protect your entire trip, from the moment you leave home until the moment you return. Faye’s entire trip protection covers your trip, your health, and your stuff. You can see everything Faye covers, as well as what you can add on to your plan, here.

For additional questions about what Faye travel insurance covers, our customer experience team is available to answer questions 24/7, 365 days a year – even on weekends and holidays. You can chat with them via the Faye app on iOS or Android or contact them at support@withfaye.com.

Looking for more helpful content on travel insurance and all things travel? Read more with Faye here.