Planning for the worst and hoping for the best is the way to go when it comes to travel. And one of the best ways to plan for unknown stressors that could pop up pre-trip is to opt to add the Cancel For Any Reason (CFAR) benefit to your travel protection plan.

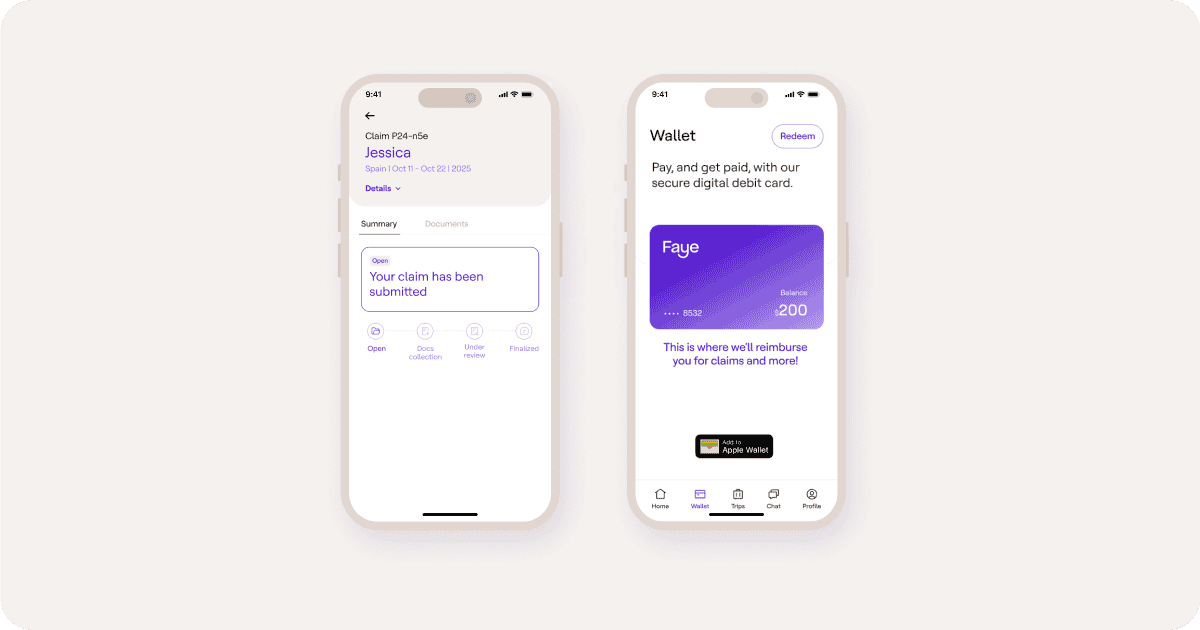

With Faye, CFAR can cover up to 75% of non-refundable trip costs if you need to nix your trip for reasons not otherwise covered under the plan. You just need to purchase this coverage within 14 days of the date your initial trip deposit is received, and you must cancel your trip at least 48 hours in advance of your scheduled trip departure date.

CFAR may not be necessary for all your trips, but here are some of our top examples of when it can be a good decision:

1. If you frequently experience urgent schedule changes at work. These happen and sometimes they come at the most inconvenient times. For example, if you’re a doctor and find out that you need to cover for another surgeon that got sick, CFAR could help you get back some pre-paid trip expenses so you can reschedule your trip for a better time.

2. You have anxiety about traveling. It’s no surprise that traveling can be stressful. If you’re nervous about heading out of town and are not 100% certain about your upcoming adventure, it might be best to add on Cancel For Any Reason. This way you are not out everything you put in and can wait until you feel better about heading to your dream destinations.

3. You’re concerned about contracting COVID-19. It’s completely understandable if you’re hesitant to travel due to COVID-19. If you think you may want to cancel your trip over fear of contracting the virus, then CFAR might come in handy to make sure you don’t lose your entire trip investment.

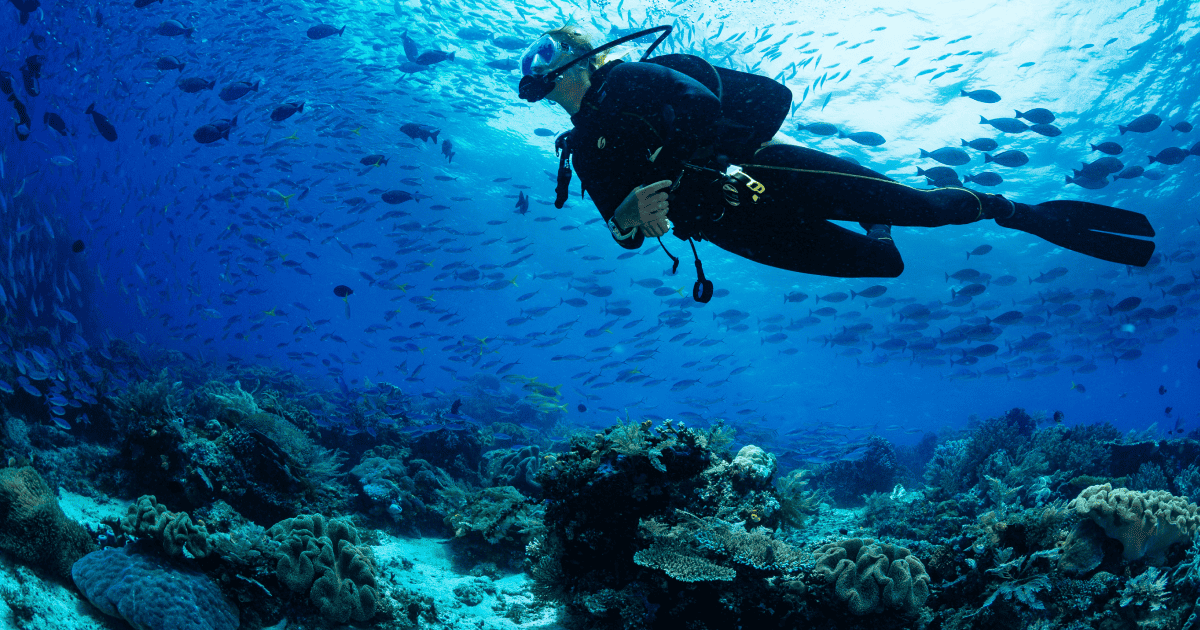

4. You invested a lot of money in your trip. If you’re booking your dream cruise to Antarctica, a 5-star safari in Africa or a once-in-a-lifetime scuba excursion in Australia, you may want to make sure you protect some of your investments before you depart in case things don’t go as planned. CFAR is an excellent protection to have if something unexpected occurs and derails your dream vacation.

5. You’re traveling with a large party. If you’re planning a big family trip or friends get-together and you aren’t booking as a group, we recommend adding on CFAR. Group trips can be a bit tricky to coordinate and CFAR can reimburse your pre-paid expenses, so you’re protected in case people can’t go and you want to cancel your trip.

Want to know more about the Cancel For Any Reason travel insurance benefit and how it works? Find out here.

All claim examples are subject to the terms of the plan document. Additional cost and terms apply. CFAR is not available in NY.